Youtility

I joined Youtility as the Lead Designer in 2018 on a mission to help consumers take control of their household finances and save money on their expenses.

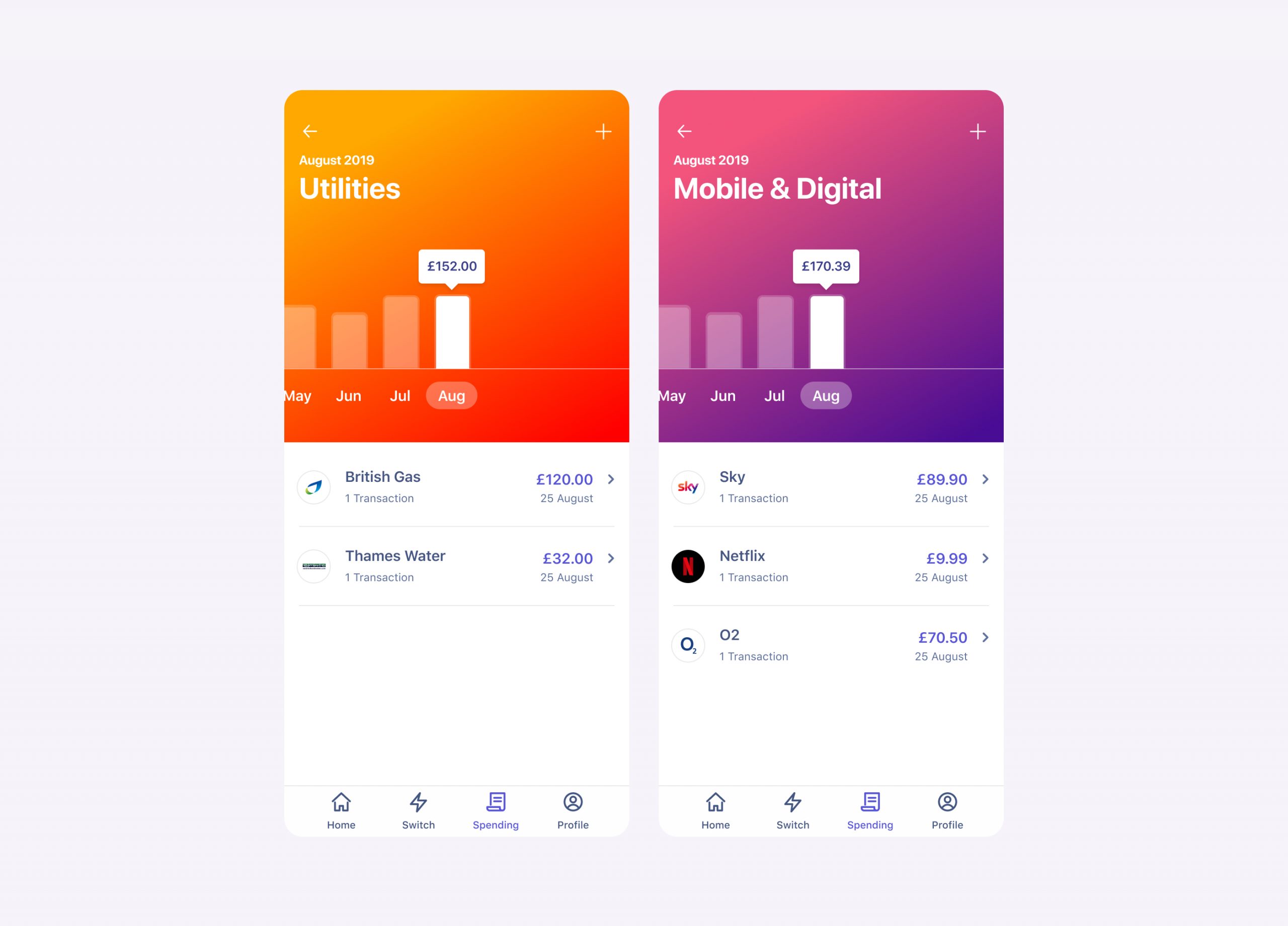

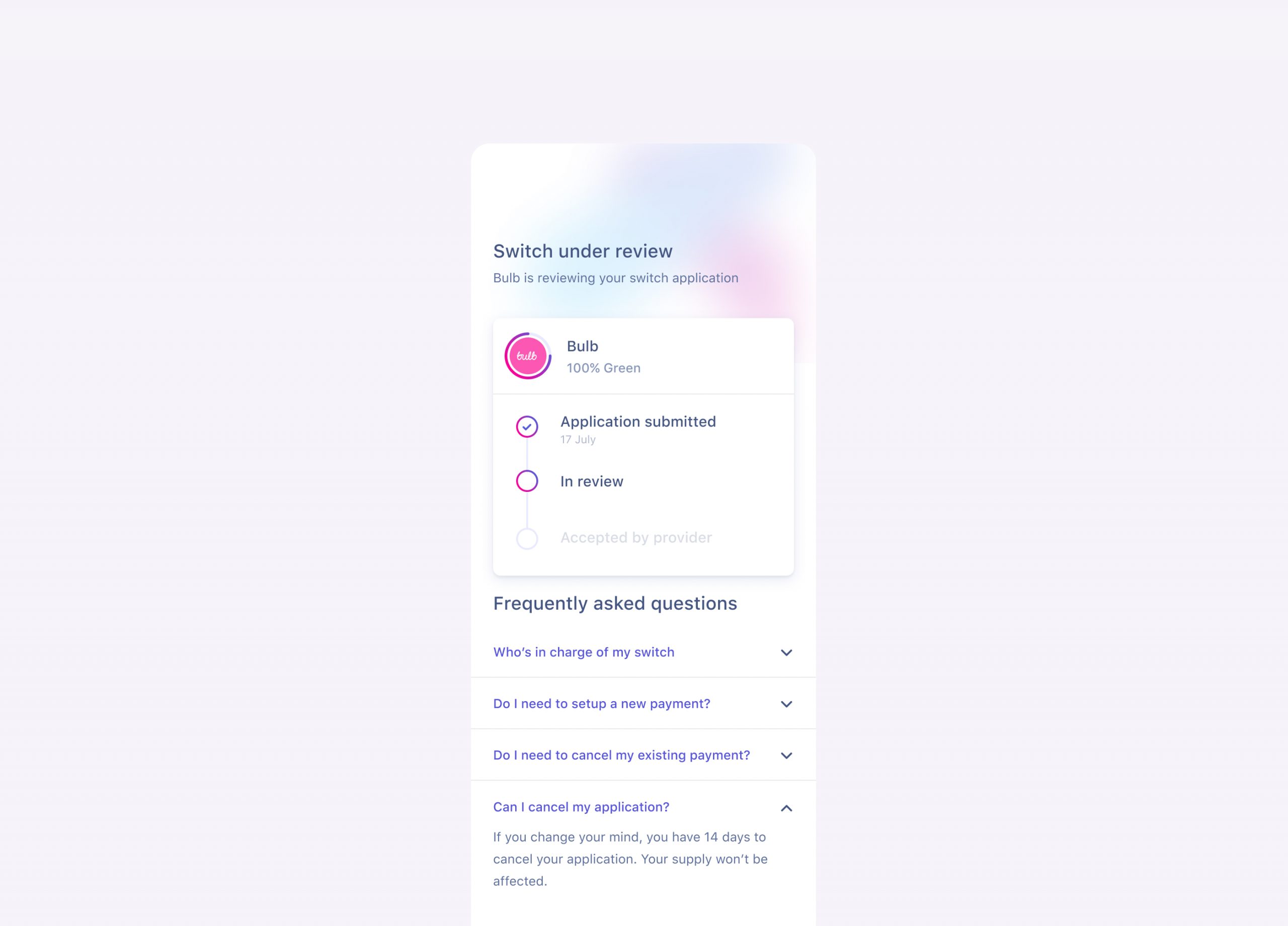

My work involved rethinking our utility provider switching flow, resulting in a best-in-class experience that completely changed how consumers switched providers in the UK.

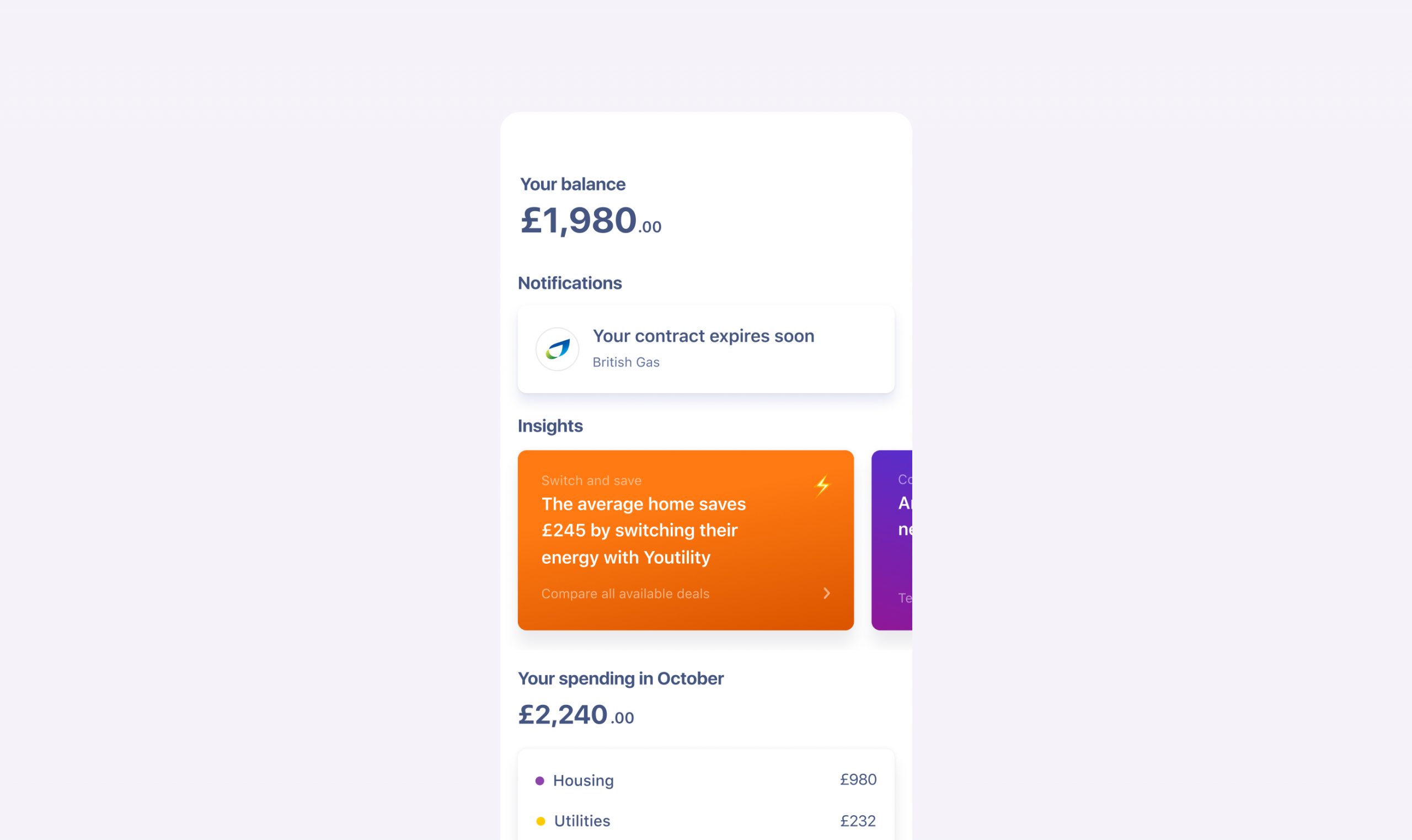

Another core feature that we developed during my time as the design lead was a brand new dashboard for our consumers, giving quick insights on the user’s spending for the month, notifications on expiring contracts and upcoming bills, and most importantly tips and insights on how to save money on household expenses.

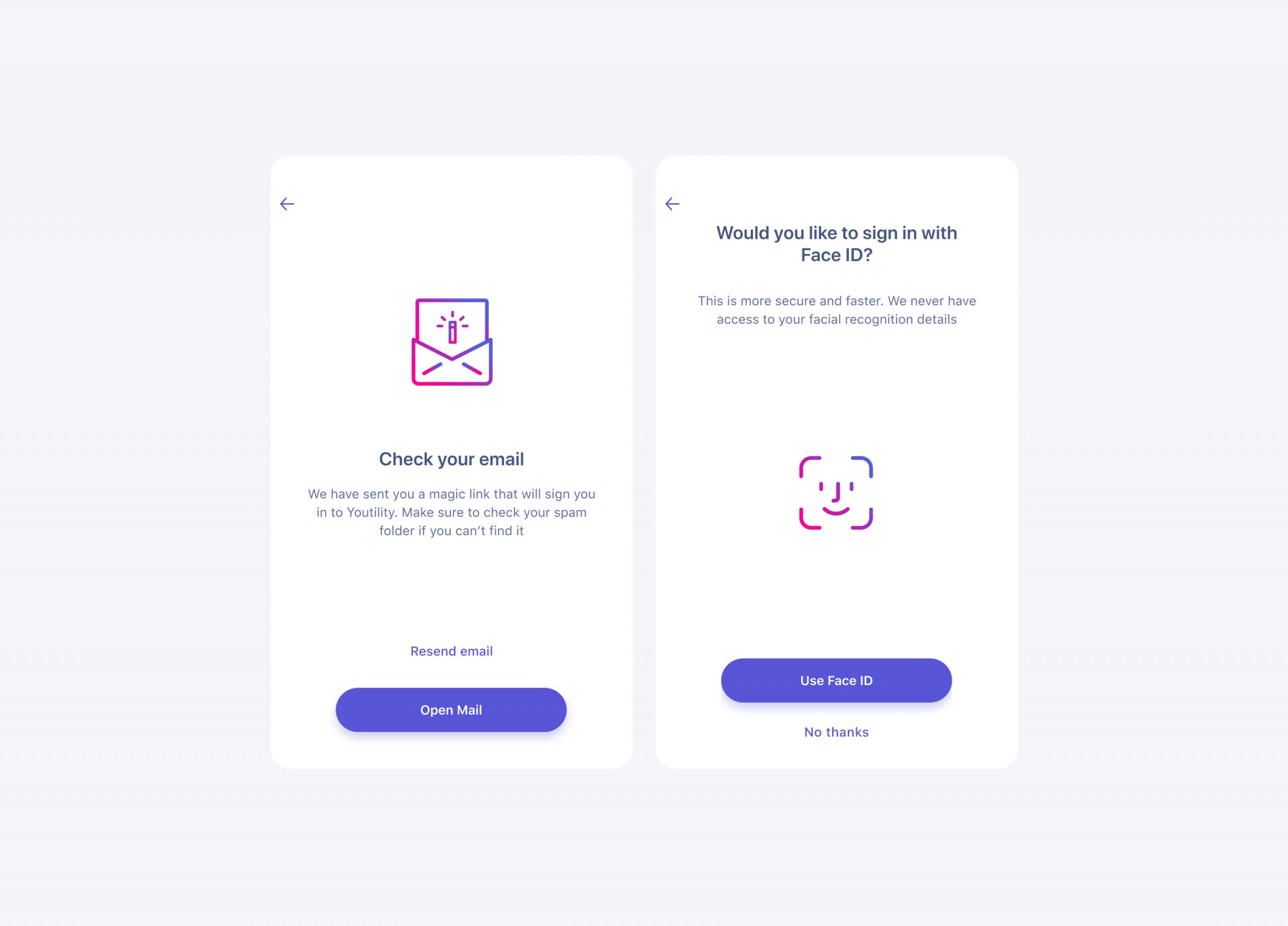

One of our core guiding principles when designing the Youtility consumer application was maintaining a balance between simplicity and security, while still keeping all the information predominantly transparent for our users.

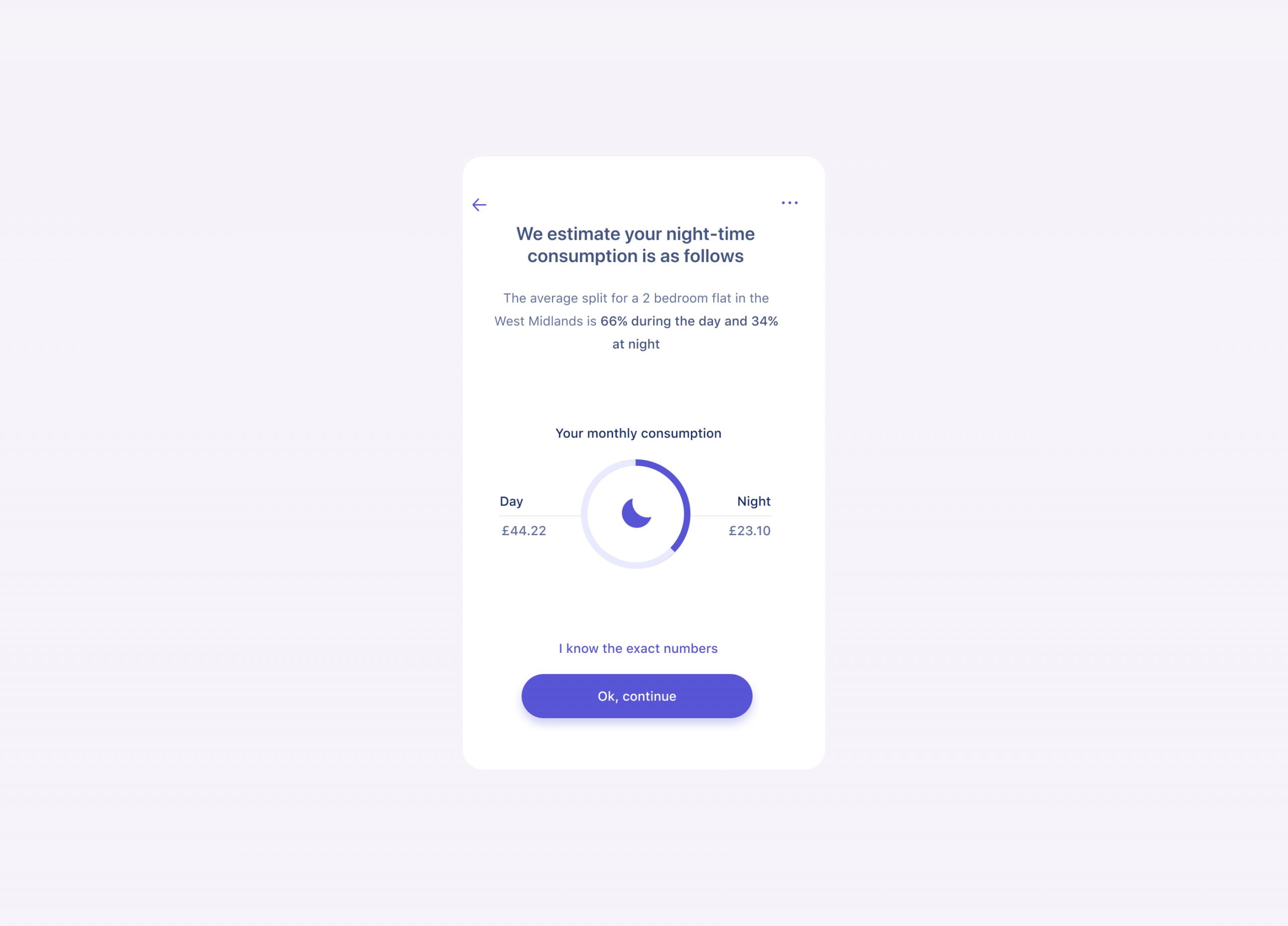

As a result, any complex flow that involved multiple steps, for example the onboarding experience or our best-in-class energy provider switching experience, showed clear information at every step of the process, leveraged simple wording to communicate why we requested specific information, and directed the user towards taking the right action at the right time.

The biggest challenge we faced in the utility switching space was the tedious, long sign up flows, as well as the lack of clarity on a lot of the information that is often required.

We spent a lot of time with both stakeholders, product managers and data analysts in trying to understand where we could use technology, data and insights in order to make the experience much clearer and significantly simpler to the end consumer. We used several interview cycles with end consumers in order to assess which steps we could completely skip, as well as which parts of the process we could successfuly automate.

The Youtility consumer application was very positively received by users and was featured in Apple’s App Of The Day twice. It also paved our way to integrating with banking institutions and fintech companies, ultimately developing the company’s business-to-business offering.